The Client:

Our Hunting Industry Client is a leading retailer and manufacturer of hunting products in the UK. With a strong market presence in the UK, they also have an expanding international footprint, bringing high-quality hunting gear and accessories to customers worldwide. Their portfolio includes well-known brands and their own products, ensuring competitive offerings in the industry.

The Challenge:

The Hunting Industry Client approached us for our expertise to optimize their marketplace performance and maximize profitability. Managing multiple sales channels through the Rithum (ChannelAdvisor) platform presented challenges in efficiency, visibility, and revenue optimization.

They needed a strategic approach to streamline operations, improve product positioning, and implement data-driven solutions to increase margins. Our goal was to refine their marketplace strategy, optimize their integration and drive sustainable growth in net profit.

The Solution:

To drive success, we implemented a series of strategic improvements across their Rithum (ChannelAdvisor) platform and marketplace operations.

We began by redesigning the Rithum setup, enhancing platform efficiency, and optimizing existing configurations to ensure seamless functionality. A critical challenge appeared due to unexpected Amazon updates, which resulted in 30% of the client’s products failing to list, displaying an unknown error in Rithum (ChannelAdvisor). Our priority was to diagnose the issue and develop a solution that would restore all affected products to active status via the Rithum (ChannelAdvisor) platform.

To maintain a data-driven approach, we created a comprehensive reporting system that provided a week-on-week analysis of profit margins and key performance metrics. This allowed us to make agile adjustments and align strategies with the client’s financial goals. Our primary objectives included increasing the gross profit margin by over 20% and boosting the overall YOY net profit margin by 10%.

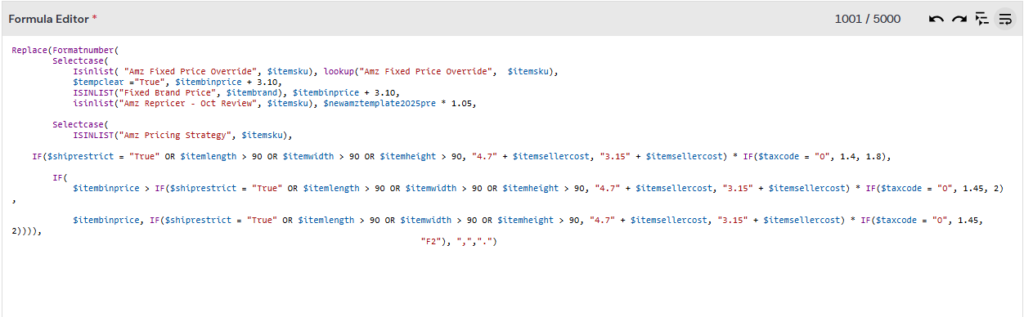

We also conducted an analysis of the pricing structure within Rithum (ChannelAdvisor), rebuilding it from the ground up to align with the agreed profitability targets. A significant issue identified was the high volume of orders being sold at a loss due to an ineffective pricing rule. To address this, we optimized the pricing business rule, significantly reducing loss-making sales to entirely eliminate them.

Additionally, we executed a deep-dive analysis of the client’s advertising strategy, with a focus on increasing Return on ad spend to over 10. We restructured their entire advertising approach, leveraging all available ad formats and capabilities to maximize visibility and drive higher conversions across their product range.

The Results:

Managing the Rithum platform became significantly more efficient for the client. We streamlined complex structures, simplifying them for easier navigation and future use. Additionally, by taking over the day-to-day platform management, we reduced the client’s operational burden, allowing them to shift their focus to broader business growth rather than dealing with technical challenges within Rithum (ChannelAdvisor).

To resolve the product listing issues, we optimized the Rithum (ChannelAdvisor) Amazon template, implemented necessary rules, and mapped the mandatory attributes that were previously causing errors. By systematically addressing these issues and relisting the affected products, we successfully restored product visibility on Amazon, leading to a direct increase in sales.

A critical breakthrough came from restructuring the pricing rules. By eliminating unprofitable sales, we ensured that every transaction contributed positively to the business. The weekly reporting system provided a clear and actionable overview of sales performance, allowing us to optimize the pricing strategy until all loss-making sales were eliminated.

We also restructured the client’s advertising strategy, adopting a more proactive approach by segmenting products and brand groups based on different profit margins. This allowed for better allocation of ad spend, ensuring that marketing efforts were driving both visibility and profitability. As a result, we increased Return on Ad Spend (ROAS) to 13.36%, significantly improving advertising efficiency while maintaining cost control.

Key Achievements:

- Gross profit margin increased to 20.38%, compared to the previous year of 13.34%;

- Net profit margin saw a 17.26% year-over-year (YOY) increase;

- The optimized pricing model maintained high margins while remaining competitive, effectively eliminating low-profit and loss-making sales;

- ROAS improved to 13.36%, enhancing advertising effectiveness and overall profitability.